#10: The Value of Partnership vs Pay for Service Model for UHNW Clients

For people with basic needs paying a % of your assets as a fee has limited upside. But for UHNW clients, it can help create the foundation for tax-efficient generational wealth management

It’s been common practice of late to label the financial advisory business model that charges a fee based on the amount of assets of yours that they manage (i.e. assets under management or AUM) as overly egregious.

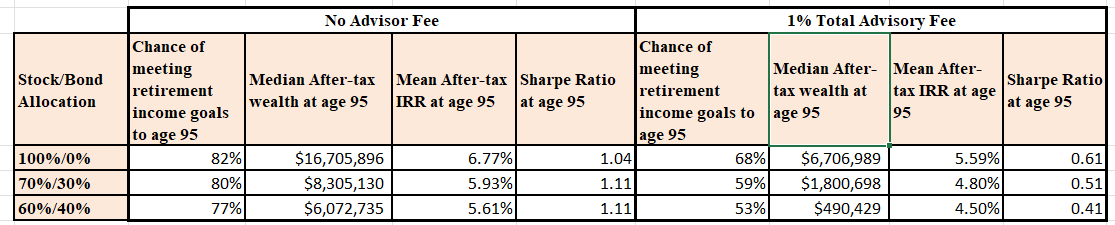

In fact, I myself have done posts on how the effect of the fee reduces clients’ chance of a successful retirement and costs clients 50%-90% of the wealth they leave to their beneficiaries.

It’s not just the fee alone that does this.

It's the fact that the drag of paying the fee, in combination with the taxes required to pay the fee, limit the ability of the portfolio to compound to a greater degree over time.

Drag of a 1% Fee Over Time on Different Asset Allocation Models

So for most clients the % of AUM fee doesn’t make sense (clients still do it anyways, however, because they don’t always understand what value they’re getting for their fee—hence the purpose for this Substack)

That’s because they have both simple financial planning needs, limited financial planning opportunities, and the utility of the lost dollar is high relative to the limited value proposition.

However, for Ultra-High Net Worth (UHNW) clients the value proposition is significantly higher due to the complexity of their needs, the breadth of solutions available, the lack of aligned interests, and the high marginal utility of the financial planning at that level.

For the purpose of this article I’m talking about clients who have now, or anticipate having in the future, $10M or more in net worth.

1. Complexity of Needs: More Money, More Problems

UHNW clients have a wide array of needs that don’t really apply to the rest of us. The first of course is the estate tax.

For those who don’t know, the federal government (and some states) tax your wealth at the time of your death—but only if it’s above a certain limit. As of 2024 this limit is $27.22 million for a married couple.

This may seem like such a large number that most wealthy people aren’t worried about it.

But they should be.

That’s because even though that limit is $27 million for a married couple today, it’s looking increasingly likely that in the future it will come down. Especially since given the growing federal deficit and the backlash against income inequality it’s increasingly likely that this limit will be coming down at some point in the future.

In fact starting in 2026 that limit is scheduled to fall to around $14M per couple.

So if you have $5M or $6M today, it’s increasingly likely that over time your portfolio will grow and the limits will likely come down even further.

Which means that even though it’s not an issue today, it most likely will be in the future so planning for it now creates more flexibility than waiting until the last minute.

Therefore, those trying to pass down wealth to the next generation are increasingly tasked with trying to use the tax code in a manner that most effectively benefits themselves and their heirs.

Their goals become less about wealth accrual and more about wealth management.

This is a fundamentally different philosophical approach to money than the rest of us have.

Most Americans are simply trying to accrue enough wealth in their working years such that they have enough amassed to retire on once their W2 sources of income dry up.

Focusing on passing down as much wealth as possible is far down on their list of concerns.

Furthermore, UHNW clients are in the highest tax-brackets and don’t have the same access to retirement accounts that the average American has at his or her disposal.

Retirement accounts offer a great way for Americans to defer income during their high tax years while they are working to their low tax years in retirement.

But UHNW clients are phased out of contributing to these when they have the greatest need for tax-free or tax-deferred benefits.

As such they are tasked with utilizing other elements of the tax-code to accomplish what the rest of Americans are able to do through retirement accounts.

2. The breadth of solutions available

While UHNW clients don’t receive much benefit from retirement accounts they have something much greater at their disposal: the rest of the tax code.

The tax code allows them to do a number of things that the rest of us receive limited benefit from. I mentioned some of them in my last post, but let’s recap a few of them:

1) Moving assets outside of their estate to protect themselves from the estate tax, while borrowing against it in case they need income

2) Overall benefits of using tax-deductible leverage to provide for income needs while letting their investments grow for the long-term

3) Ability to shield up to $10M in gains from taxes due to QSBS opportunities

4) Ability to donate appreciated assets instead of after-tax dollars to charity while receiving a tax-deduction for that donation

5) Ability to deduct paper real estate losses against real passive or W2 income

6) Receiving income at beneficial capital gains tax rates instead of higher ordinary income tax rates

7) Using tax-loss harvesting to continually offset gains

The point here is that the value of financial planning to a given client is higher when more solutions can be deployed and the value proposition is higher both due to the client’s higher accumulated wealth and tax bracket.

3. Lack of alignment

Due to the complexity of UHNW client needs they need to have a breadth of partners with specific niche expertise: an estate attorney to handle their estate planning needs, a tax professional to handle their complicated income tax needs, an insurance advisor to help manage their life insurance planning needs, and finally an investment professional to handle their investment needs.

The problem with having a myriad of different experts on your team is that each one handles their own individual responsibilities without much respect to the consequences it has on other members of the team’s tasks.

For example, moving assets outside of the estate sounds like a smart thing to do to avoid the estate tax.

But what estate attorneys may neglect to tell you is that this imposes a large income tax liability on the client without the assets to pay for it.

So moving $50M out of the estate to avoid the 40% estate tax is great. But if you have to pay $2M in income taxes every year on that money, do you have enough assets in the estate to pay for it?

Also, moving assets outside of the estate means they lose the ever valuable step-up in basis that allows you to pass on assets to your next of kin tax-free.

Is moving assets outside of the estate worth the trade-off?

If so, what type of assets should be moved outside of the estate versus kept in the estate?

These are questions that need to be answered in combination with an investment professional and a tax professional—not just with an individual solely focused on the estate parts of the formula.

The estate attorney alone isn’t typically the most qualified or unbiased source of information.

Analogously, your tax professional may just be doing your tax returns, but not proactively looking at strategies on how to reduce the tax liabilities associated with your business, investments, or estate plan.

And your investment professional may be so focused on managing your investments for a fee that they’re not addressing the impacts your investments may have on your tax-liabilities or estate planning.

This is ideally what the wealth manager should be bringing to the table. They are supposed to be the quarterback or point guard of your professional advisory team who understands how all the pieces should fit together and how to utilize each of the other players on the team in the most effective way possible.

Holistic Wealth Management: The Quarterback of the Team

I’m not saying that all wealth managers actually do this.

In fact, I’d argue that most of them don’t.

As I’ve spoken about in a previous post, the business model incentivizes most wealth managers to just put your assets in a simple model that they can charge their fee on and manage their relationship with you more so than determine optimal ways to manage your wealth.

But ideally, the wealth manager should be a jack of all trades—with the ability to manage the masters of those trades.

1. High marginal utility of wealth management for UHNW clients

The economic concept of marginal utility highlights why holistic wealth management offers the opportunity for such great value proposition here.

UHNW clients have more money than they will spend in their lifetime. They are not worried about how many more years they have to work before they can retire.

In fact, for them the value of earning an extra dollar is worth less to them than it is to the average American because they already have enough of it.

What becomes more valuable to them is both their time, freedom, and stress.

So even if a wealth manager were to do nothing more than put them in a basic model and charge them an ongoing % fee for it, their value of their own time, freedom, and lack of stress gained from it is worth more than the utility of the dollars spent on the fee.

Furthermore, as highlighted above, there are a lot more financial planning opportunities the wealthier an individual is.

Hence there is greater opportunity for the wealth advisors to put tax-efficient strategies in place that may make up for the cost of the fee entirely since the client is subject to such a large amount of income and estate taxes

So the potential for the value-added planning is high and the marginal utility of the extra dollar it will cost for the planning is low to the client relative to the value they place on their time and freedom.

Partnership vs Relationship Management

While it’s difficult to find a wealth manager who embodies all of the qualities and expertise I mentioned above, the reason why it deserves a percent of AUM fee as compensation as opposed to a per hour or flat fee type of an arrangement that you would pay to an estate attorney or tax-professional is because the wealth manager is ideally in the best position to understand how to utilize all the levers and liabilities at play (estate tax, income tax, investments, generational transfer, etc) as opposed to the individual per hour experts who are paid to focus on their individual responsibilities and NOT whether it ties into the big picture at all.

Another way to think about this is to imagine a wealthy individual is starting an asset management firm and wants to hire a CEO to run the business since they don’t know anything about the industry.

If you were the wealthy individual, what compensation package would you offer this individual?

The package you offer clearly wouldn’t be just salary.

You would have to offer some form of equity to attract the top talent and incentivize them to run it in a way that helps align interests (i.e. to ensure they don’t just show up to work for a paycheck without delivering results).

The wealth manager that the wealthy individual hires is essentially the CEO of their asset management firm. And the percent AUM compensation is essentially a form of equity being offered to the wealth manager in order to better align incentives.

Most clients who have accumulated wealth themselves have typically done so via businesses and entrepreneurship.

In this next phase of their life they are essentially transitioning from entrepreneurship to wealth/asset managers not only for their immediate family—but for successive generations as well.

For someone who has spent so much of his or her time accumulating wealth, the concept of managing their wealth is a foreign to them. While they may know the ins and outs of running and scaling a business—and the loopholes that help them to facilitate this—they aren’t aware of those same tips and tricks within the scope of wealth management.

Ideally a wealth manager is helping them to transition away from the accumulation part of their wealth journey to the “management” part.

Unfortunately, not many wealth managers are doing the extensive planning I’ve described above.

And that’s simply because they don’t have to.

As I mentioned, for an UHNW client, just paying someone to manage their finances—even if that person does little more than put the clients in index funds the client could do themselves—is worth it to them because they have excess money and limited time.

It's worth it to them to pay exorbitant fees simply to free up their time.

The wealth management community knows this.

So they don’t have to wow clients with the exceptional value their services are providing them.

They simply have to make the process an enjoyable experience for these clients. So they wow clients with beautiful offices, holiday parties, and perks.

Their goal is to focus on a healthy relationship with the client moreso than the underlying wealth management.

In this model, clients are paying less for extensive financial planning and wealth management and more for access to an exclusive country club with great relationship managers.

And to be frank, this is what many clients actually want—even though they may profess otherwise (as with everything we often say we want one thing, but our emotional biases lead us to choose differently).

But for those wealth management firms wanting to stand-out and try and attract clients who actually value the financial planning and wealth management components, the opportunity is there simply because very few are doing the holistic planning I described.

And those who do will more than deserve a % AUM fee because they’re a partner the client can depend on to help them with this transition from growth to wealth management—instead of merely charging them an exclusive country club fee for being a service provider that provides very little service.

About the Author

Rajiv Rebello is the Principal and Chief Actuary of Colva Insurance Services. He helps HNW clients implement better after-tax, risk-adjusted wealth and estate solutions through the use of life insurance and annuity vehicles. He can be reached at rajiv.rebello@colvaservices.com

You can also book a call directly with him here:

I think this is a better argument than most (the status quo is "that's how it is"), but I'm still unconvinced.

I think a % fee makes sense on "excess value", not on "total value", and when I see a % quoted on total value, I get a bit skeptical.

Are the CEOs paid their salaries on % of market cap? No, they are paid in stock grants which accrue from the _excess value_ derived during their tenure (stock appreciation). Though we may quibble over how much excess value there is (say CEO alpha vs. market beta), the idea is to attach onto excess value.

Similarly, if I hire a lawyer for a personal injury case but don't want to pay the lawyer upfront, then I may pay the lawyer a % of the case. That again is the % of the excess value - the value that would not have occurred otherwise.

I have more of an issue with a % of sale on a house. I should pay a % for you selling a $1M house for $1.2M, but not a $1M house for $1M. The latter just doesn't really make sense. I admit that calculating excess value can be tricky, but the idea that we should instead take a % of total value or a % of revenues is not actually a way to align incentives. It encourages churn and ignores what we really care about: a % on excess value (or profits). Nevertheless, it is a convenient way for the finance industry to get rich.