"Insurance is not an Investment"--well neither is your 401k (Part 1) #4

In explaining how both insurance products and 401k/retirement plans can be used as investment vehicles we compare features of annuities to those of traditional 401k plans

I see a lot of simplistic content proliferating on the internet with regards to using insurance as an investment on both sides of the equation.

On the pro life insurance side are either novice insurance professionals or financially illiterate insurance salesman hawking life insurance products as the end all be all of investments who tout all the benefits of life insurance and annuity products while conveniently forgetting to disclose all the risks (namely high early year expenses along with high cancelation rates).

Some of these influencers even advocate getting rid of your 401k to invest via a life insurance product.

On the opposite side are financial professionals who uphold the principles of long-term investing and the tax-efficient benefits of vehicles like a 401k while proclaiming that insurance is not an investment and you should never mix insurance with investing—in spite of all the tax benefits that life insurance affords for accruing long-term wealth and that the main beneficiaries of this are wealthy individuals (i.e. their clients).

So who is right?

As with most things there’s truth to be found on both sides but both sides also obscure the full story.

Since life insurance is a key component of this Substack, and is a foundational element of everything we will talk about here, I wanted to do a comparison between the two so you understand the dynamics involved as you read future posts.

In this post I’ll be comparing traditional 401ks to annuities and in the next post I’ll do a comparison between Roth 401ks and permanent life insurance.

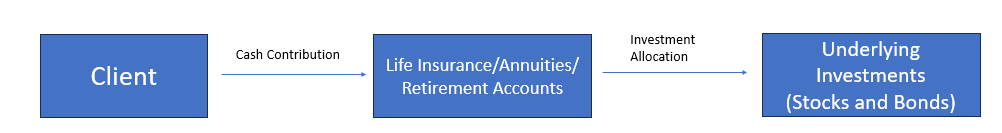

The first thing to understand is that both life insurance/annuity products and 401ks are not actual investments. They are vehicles that allow you to invest in underlying assets on a tax-deferred or tax-free basis. Each of these vehicles comes with different pros and cons and expenses.

For example, if you contributed money this past year to a 401k or retirement account either you or your company had to allocate this contribution to an investment option. Usually these investment options consist of stocks, bonds, or a mix of both.

The unfortunate thing is many people contribute to a 401k or retirement account but completely forget the underlying investments they are invested in.

For example, if I were to ask you what your 401k or retirement accounts were invested in would you be able to tell me what you were invested in or the percentage that was in stocks vs bonds?

But the key takeaway here is that a 401k is just a long-term investment vehicle that allows you to invest today so that you can reap the benefits later.

Permanent life insurance and annuity products work in a similar way. You contribute cash to the company offering the product. The company then invests that money into various investment options. Sometimes you have a say in what you’re invested in (variable universal life and variable annuities offer you choices).

Other times, the insurance company chooses the investment offering for you (whole life, universal life and annuities all invest in long-term bond portfolios).

So I thought I’d do a quick little comparison of the vehicles so that you can better understand the nuances and value proposition here.

In this post I’ll do a comparison of a Traditional 401k vs Annuities and then in the next post I’ll do a comparison between a Roth 401k and Permanent Life Insurance.

Traditional 401k vs Annuities

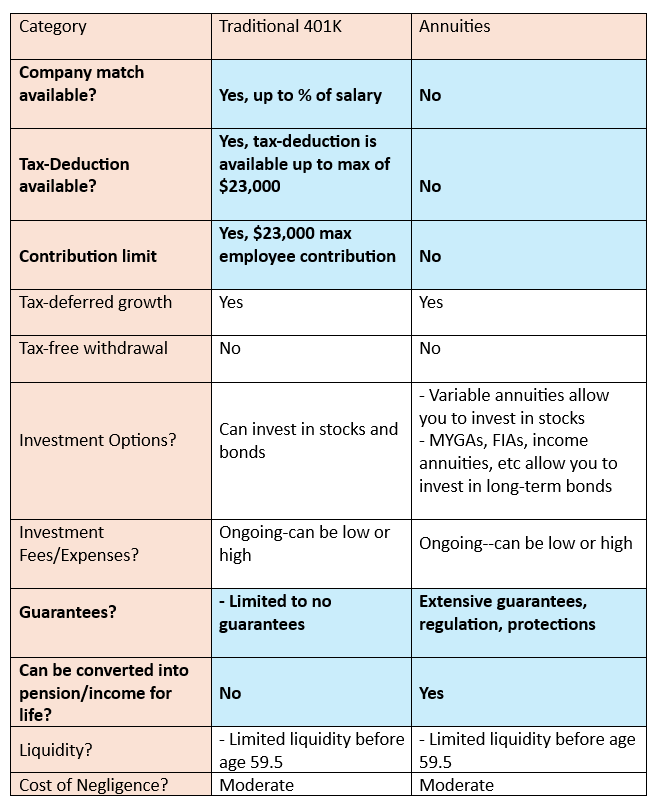

As we look at the chart above, the major difference between a traditional 401k and annuities are the categories highlighted in blue: company match, the contribution limit, the tax-deduction of the contribution, the guarantees available, and the ability to convert the savings into a pension/income for life.

1) Company Match

The company match is a key value add that cannot be found in annuities and what makes the 401k a preferred retirement vehicle as there is no such match with annuities. While some annuities offer a “premium bonus” that tries to replicate this match in the eyes of the policyowner, it’s really just a marketing gimmick.

Think of it this way: An annuity company can either give you a 5% guaranteed rate of return on your money or a 4.5% guaranteed rate of return on your money with a “15% premium bonus”. So sure you’re getting a premium bonus but in exchange you’re getting a lower rate of return on all of your money. Both are priced to be financially equivalent to each other.

2) Tax-deduction of contribution

Another major benefit of a traditional 401k plan is the tax-deduction of the contribution.

This allows employees to make a tax bracket play since most employees are in a high marginal tax bracket while they’re working and will be in a lower effective tax bracket after they retire.

So similar to the company match, this is free money to them. Imagine a married California couple making a combined $450k/year that is in a ~40% marginal tax bracket now, but expect to be in a 20% effective tax bracket when they retire.

If they were to each contribute $20k to their traditional 401k plan now, they would be saving $16,000 in taxes ($40k total contribution*0.4=$16k)

When they retire, they’ll only pay 20% on the contribution they put in or $8,000 ($40k total contribution*0.2=$8k).

That’s an immediate savings of $8,000 on their $40,000 contribution.

Another way to think about this is that they are getting a 20% federal government match on every dollar they contribute to their 401k.

3) Contribution limit

Traditional 401k plans have limits in terms of how much an employee can contribute to them. For 2024 this employee contribution amount is $23,000. However only 15% of employees with retirement plans contributed the maximum amount to their retirement plans. It’s worth noting however that 58% of employees earning $150,000 or more per year contributed the maximum amount to their retirement plans.

So while the average American can’t afford to maximize the use of retirement vehicles—the wealthy can and do.

The average American isn’t using the vehicle enough and wealthy Americans on the other hand need more tax-deferred vehicles because they are already maximizing their contributions to their retirement plans.

This is where annuities can step-in.

Wealthy Americans can contribute significantly more to an annuity than they can to their traditional 401k plan.

So for the 58% of employees who have maxed out their contribution to their employee retirement plan, annuities offer the ability to continue to contribute to a tax-deferred vehicle after they hit their employee limits.

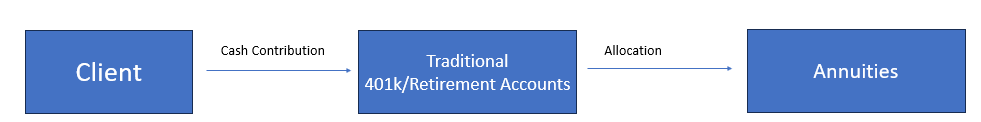

They can also purchase annuities from within their traditional 401k plans in order to avail themselves of both the guarantees and the reduced RMDs.

4) Guarantees and protections

Annuity contracts offer a plethora of guarantees and higher risk-adjusted opportunities that traditional 401ks no longer can.

As company retirement plans have moved away from defined benefit plans and towards defined contribution plans, employee retirement plans offer fewer guaranteed income or return strategies.

In order to counter this, more 401k plans are providing access to stable value funds which allow employees to invest in short-term bonds with principal protection.

However, these stable value funds will never outperform annuity contracts which allow employees to invest in higher-yielding long-term bonds with both principal protection and reserves and regulations built around ensuring that insurance companies follow through on their interest rate obligations as well.

Furthermore, annuities can offer guaranteed income to clients in retirement similar to what the pensions of yesteryear afforded employees. Clients are able to turn part of their retirement savings into a guaranteed stream of income for the rest of their life.

This is something that cannot be found in 401k plans alone.

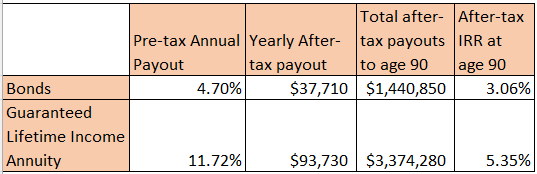

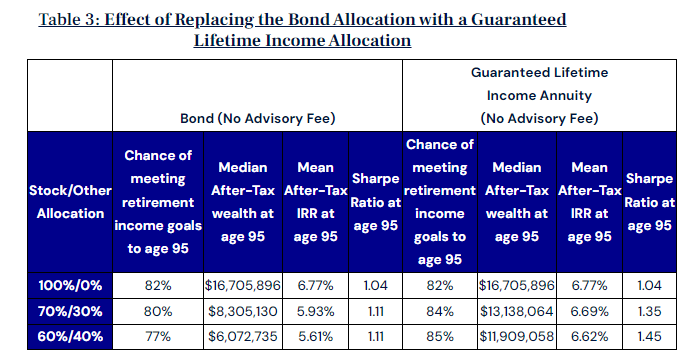

Guaranteed lifetime income annuities provide higher after-tax yields with principal protection than can be found by simply investing in short-term bonds.

Another huge benefit that guaranteed lifetime income annuities provide is the ability to grow greater long-term wealth that can be used either later in retirement or passed on to beneficiaries after death.

Since guaranteed lifetime income products have higher after-tax yields than either their short-term bond or long-term bond counterparts, clients need to sell less of their equity portfolio to meet their retirement income needs.

This allows the equity portfolio to compound at a greater rate than would otherwise be possible if clients had to sell their equity portfolio for retirement income needs.

The other features of traditional 401k plans and annuities are fairly similar.

Both traditional 401k plans and annuities allow for tax-deferral on the growth within the annuities, but not tax-free growth.

They also both allow you to invest in stocks and bonds.

The fees for both can be high or low depending on the retirement plan or annuity. That’s why it’s important to have an experienced advisor educate you on the costs of both.

Both traditional 401k plans and annuities don’t allow you to take your money out before 59.5 without penalty so there is limited early liquidity.

However, they both don’t require active management. A 401k plan allows default investment options (more often than not a target date fund) and annuities offer guaranteed returns. So clients aren’t at risk of losing everything if they just contribute to the default annuity or retirement plan options and leave it be.

As we’ll see in the next post, the same can’t be said with life insurance policies.

Not all annuities are good, but they are all investment vehicles

While annuities can provide a wealth of benefits, they tend to be commissionable products. This means that there’s an incentive for agents to sell products that pay the highest commission as opposed to those that are in the best interests of the client.

Given that these products have both surrender charge penalties and tax consequences for exiting early, it’s important that care and proper counsel be taken into consideration before choosing an annuity product.

That being said, much like a traditional 401K, annuities are investment vehicles can provide tax-deferral benefits that are highly valuable for both retirement and financial planning goals.

The added value of the annuity however, which we will dive into later in future posts, is the ability for the annuity to provide guarantees that can’t be replicated elsewhere.

About the Author

Rajiv Rebello is the Principal and Chief Actuary of Colva Insurance Services. He helps HNW clients implement better after-tax, risk-adjusted wealth and estate solutions through the use of life insurance and annuity vehicles. He can be reached at rajiv.rebello@colvaservices.com

You can also book a call directly with him here:

https://colva.youcanbook.me/