#12: Why You're Not Using Bonds Properly As An Equity Hedge--Unless You're Using Life Insurance Products

The interest rate risk of bonds negates the value of using them as a long-term hedge against equity risk. Life insurance and annuity products provide this protection.

So equity markets took a major hit in the first week of August 2024 and as is usual the case in times like this everyone is all of a sudden looking at ways to diversify against this risk (although ideally this needs to addressed before such events take place).

My goal in this post is to show how the traditional financial planning approach of just relying on bonds to offset equity risk isn’t the most reliable one.

Traditional financial planning involves just sticking clients in a portfolio that is a mixture of stocks and bonds for the long run (eg a 60/40 stock/bond portfolio) and relying on bonds to protect against equity risk in times like this.

In this post I look at research from Aswath Damodoran and AQR Capital Management to show why the interest rate risk posed by bonds makes them a poor equity hedge in times when you need it the most.

I’ll then show how investing in bonds through life insurance helps protect the negative stock-bond correlation that is what is needed to make bonds a good hedge against equity risk.

Current modern portfolio theory involves using a mixture of stocks and bonds in the construction of a portfolio.

Stocks traditionally provide the “growth” portion of the portfolio whereas bonds typically provide the “safety” portion of the portfolio.

In our last post we talked about the importance of reducing volatility and correlation in a portfolio.

Well, in theory, that’s what bonds are supposed to do. Bonds are less volatile than stocks and are thought to have a negative correlation to stock markets.

As such, using bonds are supposed to create a greater risk-adjusted return for the portfolio than just using stocks alone.

However, bonds don’t provide the safety they’ve otherwise been led to believe they should due to the high taxation of the coupons as well as the interest rate risk embedded in the principal that is directly correlated to market movements.

We’ll be covering the interest rate risk and stock-bond correlation in this post and the taxation problem in our next post.

But before we get into the issue bonds pose for clients (and how to make investing in bonds more effective), let’s first look at the two primary reasons bonds are used as an equity hedge in the first place:

1) Bond markets are less volatile than equity markets, so utilizing them reduces overall volatility in the portfolio and can create a higher risk-adjusted return—even though using bonds may reduce the overall expected return of the portfolio (since they have a lower long-term return expectation).

2) Bond markets are thought to be negatively correlated to equity risk, so utilizing bonds is thought to offset some of the equity risk in the portfolio.

Before diving into this in more detail, it’s helpful to look at some historical results

Below are stock and bond returns and standard deviation as well as the risk-adjusted return of each from 1928-2023:

Figure 1: Stock and Bond Returns 1928-2023

The above table shows that while the return (Column A) of the S&P500 has outperformed corporate bonds since 1928, it also has come with a lot more risk as measured by the standard deviation (Column B).

So measuring return relative to risk (Column C), bonds provide the highest risk-adjusted return.

So if we were measuring this purely from a risk-adjusted basis, we would have to choose bonds.

This is a tough pill to swallow for those looking at the higher returns of stocks over the long-run and wanting to capture some of that upside.

What if we were to invest in a mix of stocks and bonds?

Would that reduce the risk of the portfolio?

Would that allow us the ability to capture some of the upsides of investing in stocks while reducing the risk by capturing some of the safety of bonds?

Well that depends on how correlated stock and bond returns are to each other as we indicated in our last post. The more negatively correlated stocks and bonds are to each other, the more it will reduce the risk of the portfolio. If the two are positively correlated to one another, then you could be adding more risk to the portfolio instead of just investing in the less risky asset.

To understand why, I’d definitely recommend reading our last post.

But to understand why bonds are not a great hedge for equity risk for clients, we need to focus on both correlation and taxation.

We’ll tackle correlation in this Substack article and taxation in the next.

Bonds Are Not Always Negatively Correlated to Equity Risk

So as mentioned above, it’s often thought that bonds are negatively correlated to the stock market.

However, research has shown that the stock-bond correlation is not always negative (in fact it was almost entirely positive from 1970-1999) and is highly dependent on the other economic conditions—namely economic growth and the growth in inflation.

The below chart is taken from research done by AQR which can be found here.

Figure 2: Correlation between Stocks and Bonds 1900-2022

Let’s look at the effect of two factors—economic growth and inflation—on the stock-bond correlation from an intuitive perspective.

1.High economic growth is linked with negative stock-bond correlation

As an independent variable, large real economic growth has been shown to result in a negative stock-bond correlation—as the AQR team as well as multiple other researchers have demonstrated. From an intuitive perspective economic growth is often linked to enhancements in productivity. Over time, companies develop improved technology or ways of delivering value to consumers more cost-effectively than before. This enhanced productivity is rewarded in both sales and market value of the companies offering this new technology or service models. Therefore, growth in equity markets is often tied to economic growth.

Furthermore, what happens if companies are actively growing and scaling their businesses?

Typically they need more capital and are looking to borrow more capital from banks as a way to reinvest in their businesses.

This higher need for borrowed capital places upward pressure on short-term interest rates.

And of course an increase in short-term interest rates means that bond returns will go down (since interest rates and bond returns are inversely correlated).

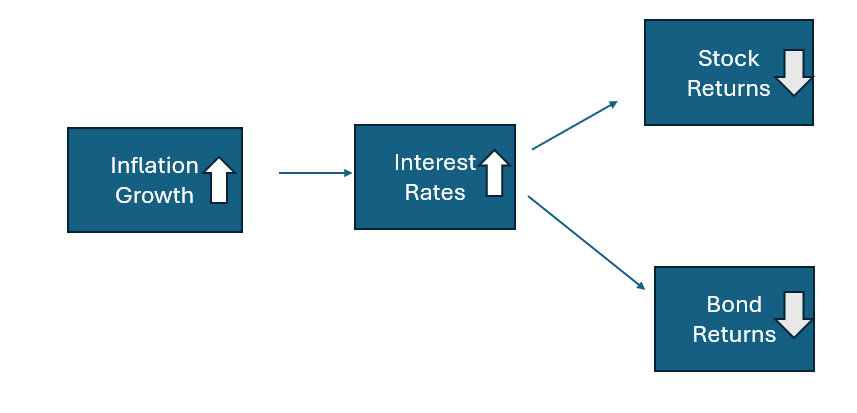

Figure 3: Economic Growth leads to Negative Stock Bond Correlation

Therefore in a strong economy, stocks and bonds have a negative correlation.

We can see that the opposite is also true.

In a period of declining economic growth, short-term interest rates will decrease to help spur the economy. This obviously causes bond returns to increase.

So in a declining economy, stocks and bonds also have a negative correlation.

2.High growth in inflation is linked with positive stock bond correlation:

As we saw in 2022, high inflation growth is linked with a positive stock bond correlation.

Both stock returns and bond returns were negative in 2022.

Figure 4: 2022 Stock and Bond Returns

Why is this?

High growth in inflation means that short-term interest rates will rise as a way to combat this inflation. Higher short-term interest rates make bonds returns go down in value AND make it more difficult for companies to borrow money and scale their business. Which means that economic growth starts to slow as well. Furthermore, a rise in interest rates means that the valuation of companies decreases due to the lower net present value of these companies. So share price of these companies go down.

Figure 5: High Inflation Growth Causes a Positive Stock-Bond Correlation

This is exactly what happened in 2022.

The Fed raised interest rates and bond returns and equity returns took a large hit because of it.

So when inflation is growing rapidly, stocks and bonds are positively correlated.

Analogously in a period of deflation, where prices of goods are dropping, the value of companies decrease due to lower expected future revenue. So equity share prices go down.

In order to combat this deflation, the Fed will typically lower interest rates by buying U.S. bonds to help increase the supply of money in the economy (which would lead to more spending and higher prices). These lower interest rates cause bond returns to increase and spur growth in the economy/equity prices

So in a period of deflation, stocks and bonds are also positively correlated since both are seeing positive returns as interest rates are lowered.

And this is why the level of inflation or deflation growth is linked to positive stock-bond correlation in both cases.

3. Growth in Inflation matters more than Economic Growth to the Stock-Bond correlation

From looking at the above two categories, we know that the high economic growth leads to a negative stock bond correlation, but high growth in inflation leads to a positive stock-bond correlation.

But what has the greater impact on stock-bond correlation? Economic growth or growth in inflation?

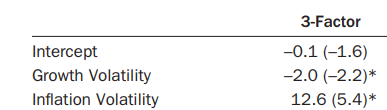

The researchers at AQR did a regression analysis on this and found that growth in inflation had a much larger impact on the stock bond-correlation than economic growth.

Figure 6: Growth vs Inflation Regression Analysis on Stock-Bond Correlation

What the regression analysis shows is that the stock-bond correlation is 6 times more sensitive to changes in inflation than they are to changes in economic growth.

With a regression coefficient of 12, if inflation increases by 3% the stock-bond correlation will increase by 36%.

Analogously if inflation decreases by 3%, the stock-bond correlation will decrease by 36%.

The bottom line here is that you can’t depend on bonds to offset equity risk in an economy in which inflation is rising quickly.

Interest rate risk is what makes bonds a poor hedging tool for equity risk

The point I’m trying to raise here is that the use of bonds as a tool to hedge equity risk is limited due to interest rate risk.

You can’t use them in periods of rising inflation so just sticking retirees in a static 60/40 portfolio for their retirement years and calling it a day is insufficient. You could very well be exposing them to lower risk-adjusted returns than if you were to choose a portfolio with a higher equity allocation—which of course defeats the purpose of why you were using a high allocation of bonds to begin with.

It's not that bonds are bad in and of themselves—it’s that the interest rate risk that rising inflation poses (via increasing short-term rates to fight inflation)—exposes bond investors to the same risk that they were looking to avoid in equity markets.

And like in 2022, times of high growth in inflation is exactly the times that you need bonds to offset equity risk.

And bonds fail to do so during such times.

But it’s important to note that interest rate risk is only associated with the principal of the bond and not the coupon payment.

It’s the price appreciation/depreciation of the bond that poses all of the risk. Meanwhile the coupon payment is what provides all of the return and has the highest risk-adjusted return.

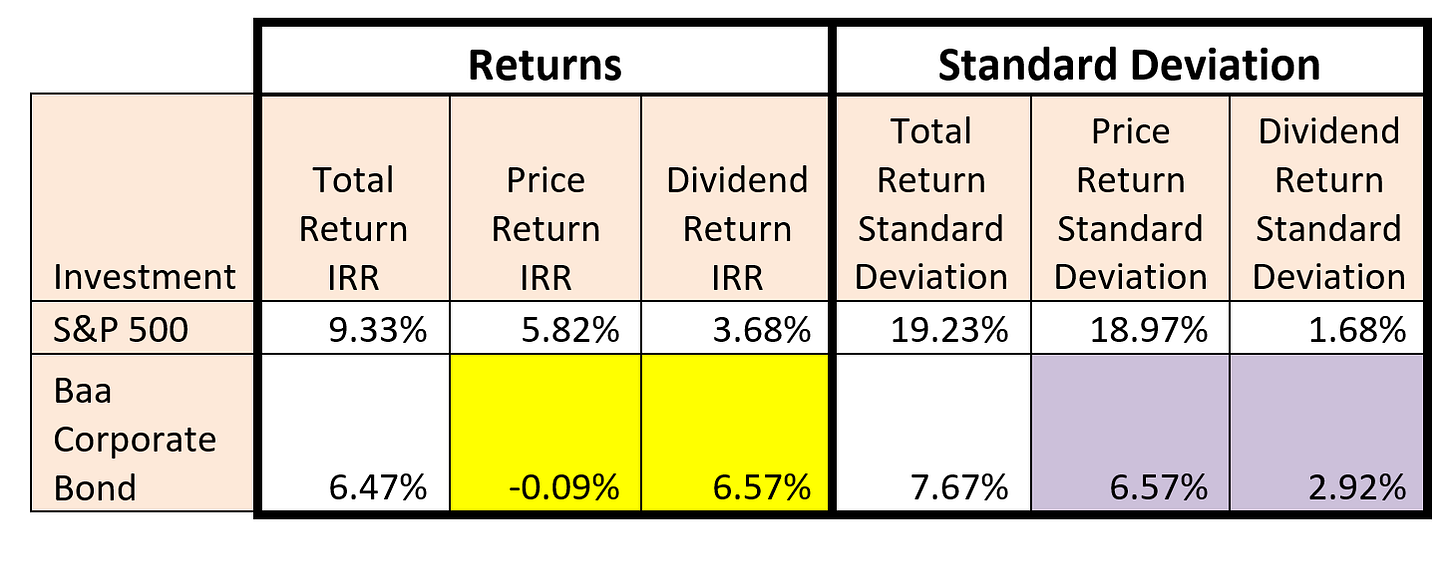

We can see this in greater detail by breaking both stock and bond returns into individual components: Price return and dividend return as shown in the table below:

Figure 7: Stock and Bond Price and Dividend Returns From 1928-2023

The above table shows the total return and total standard deviations for stocks and bonds from 1928-2023. The data was taken from Aswath Damodoran’s research which can be found here.

Let’s focus on the Return data in the three left-hand columns first.

We can see that the Total Return IRR for stocks is 9.33% while the Total Return IRR for bonds is 6.47%. In other words, since 1928 there has been an equity premium here to be earned by investing in stocks over bonds. We saw this at the beginning of our post in Figure 1.

However, the interesting thing to note here is how this Total Return IRR is broken down between price return and dividend return. With the S&P500 we can see that the bulk of the return (5.82%) is driven by the price return of the stock while the dividend return (3.68%) makes up less than 40% of the Total Return IRR of 9.33%.

However, a completely different story is seen when we look at the bond returns.

The entirety of the 6.47% total bond return IRR is driven by the dividend return of the bond (6.57%). In fact, the price return of the bond is negligible at -0.09%. I’ve highlighted both of these in yellow to draw your attention to it.

This makes sense when we think about it. Interest rates can go up and down in the short-term. But over the long-run, they will be more or less distributed along a mean return for bonds. Therefore interest rate increases will be offset by interest rate decreases resulting in a net 0% appreciation of the bond over the long-run.

This is exactly what we see in the data.

Therefore if we’re investing in bonds for the long-run, it’s the dividend yield of the bond we should be focused on.

Now let’s take a look at the volatility or standard deviation shown in the 3 righthand columns.

We can see that the Total Return Standard Deviation of the S&P500 is 19.23% while the Baa Corporate Bond is only 7.67%.

And this is why wealth managers use bonds in their portfolio construction. The volatility of the bond markets are significantly lower than that of the stock market.

So the idea is that by using bonds in the portfolio—even though they have a lower expected return than stocks—it will reduce the overall volatility of the portfolio and therefore create a higher risk-adjusted return for the overall portfolio.

However, as we saw in our last post, this assumption is entirely dependent on the stock-bond correlation being negative.

And this is not always the case. In fact from 1900-1999 it was positive as we saw in Figure 2.

If we dive into the volatility numbers further, we see that the bulk of the volatility for both the stock and bond returns are driven by the price return and not the dividend return.

The disparity in the price return standard deviation versus the dividend return standard deviation is stark for both stocks and bonds. For stocks, the price return standard deviation of 18.97% is more than 11 times that of the dividend return standard deviation of 1.68%.

And for bonds the price return standard deviation of 6.57% is more than 2 times that of the dividend return standard deviation of 2.92%. I’ve highlighted these numbers in purple for added emphasis.

We can try and normalize these numbers from a “risk-adjusted return” perspective by taking the returns in the table above and dividing it by the corresponding standard deviation.

We can see that in the table below:

Figure 8: Return/Risk Ratio of Stocks and Bonds from 1928-2023

Once again we see that bonds have the highest Total Return/Standard Deviation when compared to stocks, i.e. the highest risk-adjusted return.

But that’s not the full story.

Diving deeper we see that the dividend return of both stocks and bonds provide the greatest risk-adjusted return (2.19 and 2.25 respectively).

Once again this makes sense. The price return of stocks is too volatile to provide a great risk-adjusted return.

If you were trying to maximize your risk-adjusted return with stocks, you’d want to only invest in the dividend portion of stocks.

But you can’t do this with stocks. You can’t just invest in the dividend portion of stocks. If you invest in stocks you have to take the risk that comes with the price appreciation.

But life insurance and annuity products on the other hand allow you to invest in only the dividend portion of bonds. You are getting the bulk of the dividend return and the insurance company is taking all of the interest rate risk.

This is how you get the highest risk-adjusted return from investing in bonds—while also allowing you to invest in bonds in such a way that keeps the stock-bond correlation negative as we’ll see in the next section.

Life Insurance And Annuity Products Allow the Stock-Bond Correlation to Stay Negative

When you purchase a life insurance and annuity product, the insurance company goes and buys long-term bonds with your investment. They then give you the bulk of the dividend return. They keep a spread on this long-term yield in exchange for taking all the interest rate risk.

I’ll cover this in more detail in a future post.

But for now take a look at the chart below to understand the flow of investment and returns between the client, insurance company, and long-term bond returns.

Figure 9: Investing in Bonds via a Life Insurance Product

The insurance company is ok with the interest rate risk because they have long liabilities (these liabilities can extend 40 to 50 years or more) and are holding these bonds for the long-term. As we showed up above, the interest rate risk over the long-term is negligible. If interest rates rise, they’ll take a short-term write down on the value of their portfolio. But they are buy and hold investors that manage the liquidity demands of their clients well, so they are not as concerned with these short-term paper write-downs. Especially since this loss will be partially offset by any new investments they make in bonds which will be higher earning.

So they are more than comfortable taking this risk over the long-term while earning a spread between the yield of the long-term bonds they are invested in are earning versus what they are crediting to their policyowners.

Individual policyowners don’t have this same time horizon. They don’t have the luxury of waiting 40 to 50 years for interest rate risk to even out—especially if they’re close to or near retirement and need the cash.

So what life insurance and annuity products fundamentally do is allow you to capture the highest risk-adjusted return possible from bond investing by capturing the yield without any of real risk here that comes from changes in interest rates.

When you invest in a life insurance or annuity product you are in effect buying a long-term bond with a put option against interest rate risk in exchange for a portion of the long-term bond yield.

This is the best of both worlds for the investor. Plus the investor gets the benefit of tax-deferred or tax-free returns as a bonus (I’ll cover this in more detail in the next post).

It doesn’t get much better than that.

Most importantly though, and what often gets neglected, is that investing in bonds via a life insurance or annuity product allows the stock-bond correlation to stay negative for the individual investor exactly because they are getting the dividend yield and not the interest rate risk.

"When you invest in a life insurance or annuity product you are in effect buying a long-term bond with a put option against interest rate risk in exchange for a portion of the long-term bond yield. "

Let’s look at a couple examples:

1) Interest rates go up: Stock returns go down, bond dividend yields go up: Negative Stock-Bond Correlation

As we discussed above, when interest rates rise to prevent inflation, stock returns go down due to the discounted valuation associated with higher interest rates (assuming an upward sloping yield curve). This also hurts total bond returns—but only because of the effect on price appreciation due to interest rate risk. However, the dividend yield of bonds is actually increasing due to the increase in interest rates.

So when stock returns are going down due increasing interest rates, the dividend yield of bonds are going up. In other words, they are negatively correlated.

By protecting investors against interest rate risk, insurance and annuity products are allowing the stock-bond correlation to remain negative.

Figure 10: When interest rates go up, stock returns go down, but bond dividend yields go up--Negative Stock-Bond Correlation

2) Interest Rates Go Down: Stock Returns go up, Bond Dividend Yields Go Down: Negative Stock-Bond Correlation

In a period of declining economic growth or recession, interest rates are typically lowered to spur investment into the economy. This typically leads to positive economic growth and stock returns. However, the lowered short-term rates lead to lower dividend yields on bonds.

So in other words, as stock returns are going up due to the lower interest rate environment, the dividend yields on bonds are going down; once again a negative correlation.

Figure 11: When interest rates go down, stock returns go up, but bond dividend yields go down

Conclusion: Life Insurance and Annuity Products Provide a Hedge against Interest Rate Risk That Makes Bond Investing More Attractive

The problem with needing liquidity is that you don’t have the benefit of time to wait for your assets to recover. If you did, you could just put all your assets in the S&P500 and bet on the U.S. economy for the long-run. As we saw in the charts above, equities have outperformed bonds over a long time horizon.

The purpose of having a diversified portfolio is to protect you against downturns in the market in the case you do need the liquidity (e.g. to purchase a house, spend in retirement, etc).

Withdrawing cash in a downturn destroys the ability of your portfolio to recover because you are depleting the portfolio before it recovers and recoups the short-term losses you absorbed.

But in order to have a diversified portfolio, you need to have assets that aren’t highly correlated to each other. But as we saw in this article, investing in bond funds don’t always provide that diversification and offset to equity risk.

But bonds do provide this offset to equity risk if you invest in them without taking the interest rate risk embedded in them.

And that’s exactly what life insurance and annuity products help you do.

About the Author

Rajiv Rebello is the Principal and Chief Actuary of Colva Insurance Services. He helps HNW clients implement better after-tax, risk-adjusted wealth and estate solutions through the use of life insurance and annuity vehicles. He can be reached at rajiv.rebello@colvaservices.com .

You can also book a call directly with him here:

Thanks for the insightful post. I did have a few questions:

1. It sounds like the life insurance and annuity products behave like a bond fund + a long-dated ATM put option. In an efficient market, we should expect the two to be equivalently priced. Is that roughly the case in reality? Put another way, should I expect to get the same risk/return/correlation profile with a life insurance or annuity product as with, say, a portfolio of TLT and some puts? I'm aware that life insurance and annuity products may have some tax benefits and may be more convenient to implement, but am curious about a comparison in which these are not primary concerns.

2. In the context of stocks, we know that they are risky, but the diversification benefit of myopically buying puts to hedge that risk generally does not outweigh the premium paid. Is this story any different in the context of bonds or life insurance and annuity products?