#19: The 351 Exchange: Diversifying A Concentrated Portfolio without Taxation

How my client saved $400k+ by diversifying their concentrated portfolio without taxation

So one of my favorite client cases I worked with this year involved a high income earning client with a couple million dollars in heavily concentrated positions trying to figure out how to diversify their portfolio without taking a large tax-hit.

We ended up diversifying the concentrated portfolio into a diversified U.S. equity ETF (AAUS) offered by Alpha Architect through a tax-free 351 exchange.

This ended up allowing the client to get a diversified U.S. equity portfolio without taking a $400k+ tax-hit.

I’m going to simplify the details of the case for the sake of this article, but I think it ties in nicely to my last article about understanding how to use the tax code, unrealized gains, and step-up in basis to maximize your after-tax and generational wealth.

Concentrated positions can result in massive amounts of wealth. In fact, many of the richest people in the world today are only as rich as they are today because they held large concentrated positions in businesses that were once worth very little.

Entrepreneurs like Jeff Bezos and Elon Musk held founder shares in their respective companies that achieved massive appreciation which lead them to being two of the richest people in the world today.

If they had sold off their shares early to diversify their risk, they would be nowhere near as wealthy as they are today.

Like almost everything else in life, outsized returns can only be earned by those who take outsized risk.

Unless we’re talking about life insurance and annuity products where outsized returns can be earned by taking less risk, benefitting from the tax-code, and profiting off other people’s poor behavioral decisions. But I digress. You can read some of my other posts on this, here and here if you’re interested.

Ok, back to the main show.

People tend to glorify the positive outcomes like Bezos and Musk, but tend to sweep under the rug the stories of people who took outsized risk but ended up losing everything they have.

Everyone at a dinner party wants to learn how you got rich by YOLOing it on your own company; no one wants to hear how you lost everything you have by doing the same thing and how your kids can’t afford to go to college anymore.

If all your wealth is in the form of equity in your business, on paper you might be a millionaire. But if that company goes bankrupt then you’re broke right along with it.

So should you keep your concentrated positions and take the risk and hope you end up like Bezos and Zuckerberg?

Or should you de-risk yourself and accept a more stable growth while also making peace with the fact that doing so means you’ll have no chance of ever being able to afford your own private yacht?

That’s a personal question that has less to do with math and more with your own views on risk tolerance, the marginal value of additional wealth, and the desire to bet on yourself completely.

I don’t think most people who ever made $175 million from their company being sold in the early 2000s would ever think to invest almost the whole amount into an electric car company and space exploration company hoping to colonize Mars.

That’s crazy talk.

But that’s basically what Musk did with his Paypal money.

Most of us who achieve a certain level of wealth, however, realize that there’s much more value in protecting that wealth now that we have it than trying to increase it at the risk of losing all of it—especially since the marginal value of the extra dollar at that point to increasing our happiness and wellbeing is moot.

For us, there’s much more value in creating slower stable growth that values generational wealth and taking advantage of “financial planning alpha” as opposed to taking investment risk in search of investment alpha.

My client, a high earning couple in their 60s were in that boat.

They had a couple million dollars in large appreciated positions like Apple, Netflix, Microsoft and Berkshire that occupied a large percentage of their overall wealth. They had purchased the shares a while ago and just held onto them and now the value of their portfolio was nearly 5 times what they had acquired it for. This means that selling their concentrated portfolio to diversify into a more broad based U.S. equity/S&P500 fund would come with a $445,000 tax hit on a $1.8M stock portfolio.

Since the couple had a large amount of pension income and social security that would be coming their way in retirement and their expenses were fairly low, they didn’t need to draw down on the portfolio. In fact, they wanted to just leave the portfolio to continue to grow such that their daughter could inherit it when they pass away and receive the entire portfolio tax-free due to step-up in basis that we talked about in our last article.

However, due to their concentrated positions they have 5 stocks that comprise nearly 50% of the value of their entire portfolio. So waiting 30 years until they passed away just to avoid the $445,000 tax liability came with a lot of investment risk. If those 5 companies underperform or go out of business over the next 30 years a lot of their wealth would be lost.

This left them with 2 options:

1. Keep the portfolio the way it is today and hope that the over concentration doesn’t hurt their long-term wealth.

2. Take the tax-hit today and then diversify into an S&P500 fund

We’re going to evaluate both of these options in a second, but first let’s take a look at the portfolio.

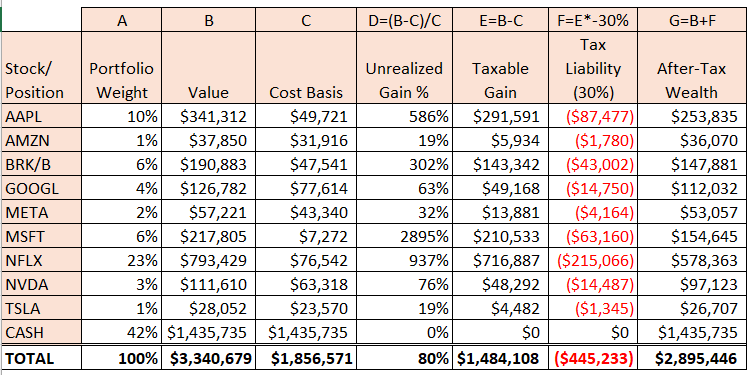

Concentrated Portfolio Details

So in the above table we can see that the client’s top 5 positions as a percentage of their overall portfolio (Column A) are the following:

1. Cash: 42%

2. Netflix (NFLX): 23%

3. Apple (AAPL): 10%

4. Berkshire (BRK/B): 6%

5. Google/Alphabet (GOOGL): 4%

What’s remarkable here is that the overall portfolio here has grown to $3.3 million (Column B) which is 80% (Column D) over the $1,856,571 cost basis (Column C) these positions were purchased at. However, that includes the cash position at $1.4 million that obviously hasn’t appreciated at all.

If we remove the cash position, the rest of the portfolio has appreciated by 353%.

That is phenomenal growth led by long-time holds of Netflix, Microsoft, Apple, and Berkshire.

However, the problem is that $1.9 million of their portfolio (i.e. the non-cash part of the portfolio) essentially has a $445,233 tax liability attached to it (Column F).

It’s a high tax-liability driven by the fact the clients are still working and plan to work for a few more years while making $500k a year combined with the fact that they live in a state (New Jersey) that has a high state tax rate on these gains.

So their $3.3 million portfolio is really worth $2.9 million (Column G) on an after-tax basis.

This is a super important point to note.

Often when people quote their net worth they focus on the pure market value of their worth (Column G) instead of the after-tax value.

Unless you’re strategic with your tax-planning you’re facing a large surprise from the IRS and state tax board if you sell your portfolio and spend all of it without leaving a large chunk of it for them to take their share.

To see the effects of the tax-drag, let’s see what would happen if the client sold their entire portfolio and purchased an S&P500 index fund versus if they just kept the existing portfolio in the table below.

We’ll also show the effects of selling either portfolio in 30 years and giving the income to their daughter versus if they kept either portfolio until their daughter inherited it with a stepped-up basis and then sold it.

So here are the four scenarios we’ll be comparing down below:

1. Keep the concentrated portfolio and sell it in 30 years and give the income from the sale to their daughter;

2. Keep the concentrated portfolio and have their daughter inherit it in 30 years when they pass away and then have her sell it;

3. Sell the concentrated portfolio today and purchase a diversified S&P500 fund and then sell that in 30 years;

4. Sell the concentrated portfolio today and purchase a diversified S&P500 fund and then have their daughter inherit it in 30 years and sell it afterwards.

We’ll assume that both portfolios are earning 8% every year for the sake of simplicity. In reality though we would expect the concentrated portfolio to have more volatile returns than a diversified portfolio—which is why the client is considering diversifying the current portfolio in the first place.

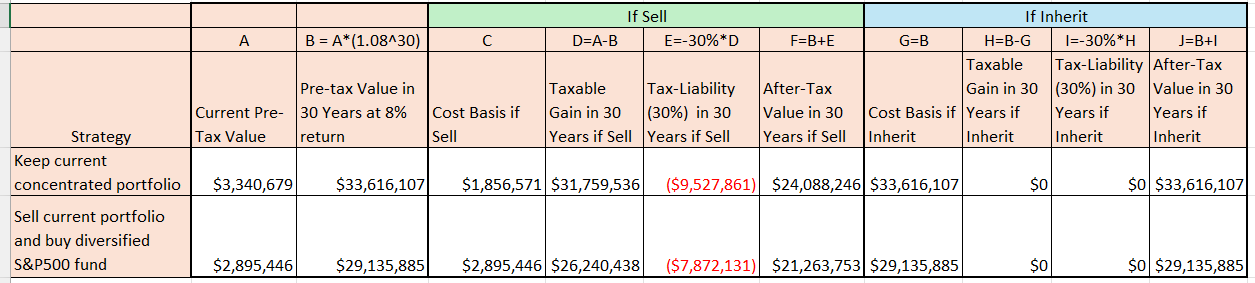

Keeping a Concentrated Portfolio Vs Diversifying It

The first thing we should notice here is the large difference in after-tax value in either strategy if the client sells the asset in 30 years and gives the proceeds to their daughter (Column F) vs if they were to die in 30 years and their daughter inherits it (Column J).

By choosing to sell the asset in 30 years, they are forced to pay $7.9-$9.5 million in taxes (Column E) vs no taxes at all (Column I) if their daughter inherits it when they pass away at that time.

And this is because if the client sells the asset in 30 years there is a large difference between the value of the asset at that time (Column B) versus the cost basis of the asset (Column C) which creates the large taxable gain (Column D) if the asset is sold.

However, if their daughter inherits the asset in 30 years the cost basis (Column G) is stepped up to the market value at that time (Column B) such that there is no taxable gain for their daughter (Column H).

As such if the client ultimate goal is to pass as much wealth on to their daughter as possible then regardless of whether they keep the concentrated portfolio or diversify into an S&P500 fund, they should not sell the positions over time and give it to their daughter but rather keep it for the long-term so that the basis gets stepped up at death and their daughter has no tax liability.

And given that best matches their goals, then it appears that if both the concentrated portfolio and the diversified portfolio have the same return, that the concentrated portfolio would result in almost $4.5 million more dollars in 30 years (Column F-$33.6M vs $29.1M).

In other words, taking a $445k tax hit today results in a loss of $4M in 30 years for their daughter if they sell the concentrated portfolio to invest in a diversified portfolio making the same return.

This is the problem we were trying to avoid.

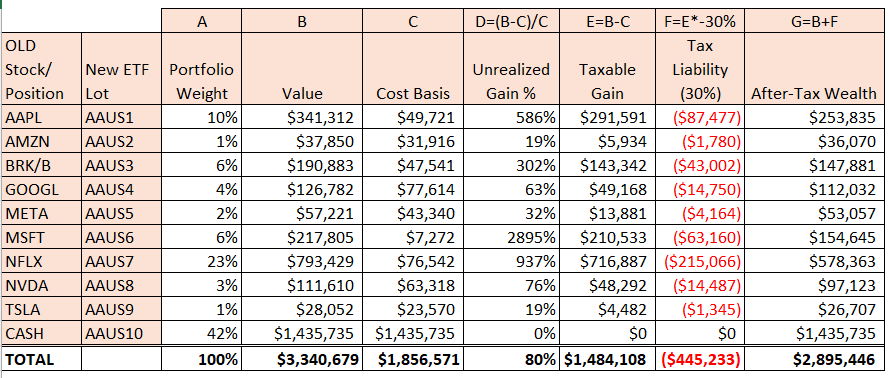

The solution we came up with was to exchange the concentrated portfolio tax-free for a diversified U.S. equity ETF WITHOUT taking the $445k tax-hit by doing a 351 exchange into a U.S. equity ETF (AAUS) offered by Alpha Architect.

A 351 exchange is a tax-free exchange that allows for tax-free exchange of stock positions and index funds into a new ETF.

There are a couple tests that dictate whether my client’s portfolio qualified:

1. The portfolio had to be worth over a million and custodied at Schwab or Fidelity

2. The portfolio consists of liquid exchange traded securities (i.e. publicly traded positions and ETFs—not mutual funds)

3. No more than 25% of the portfolio can be in a single portfolio

4. No more than 50% of the portfolio can be concentrated in 5 positions are fewer

The client’s portfolio met all of these requirements except #2 and #4 since 42% of their position was in cash. But in order to get around this we purchased an equal weighted S&P500 index (RSP) to help diversify the cash position into liquid exchange traded securities.

Each individual position in the concentrated portfolio is exchanged for a respective lot in the ETF. The upside with this is that if the client did need to sell parts of the portfolio, they would sell the lots with the least amount of unrealized gains in order to minimize the tax-liability.

So in the table below, if the client needed income they would first sell from lot AAUS10 as that would have a $0 taxable gain and $0 tax liability. So they could sell the entire lot and get all of that back on an after-tax basis.

On the opposite side, the last lot they would sell from would be AAUS6 as that has a 2,895% unrealized gain and almost the entire position is taxable.

Understanding the Value of Specific Tax Lots

Identifying Client Solutions

As I mentioned in my last article, understanding how to reposition unrealized gains within the context of a larger wealth management plan and the tax code can result in millions of dollars in more wealth for the client through financial planning. ~20 hours of planning and paperwork resulted in saving $445k today and result in hopefully more than $4M in after-tax wealth for their daughter.

That’s a 15% financial planning alpha or the equivalent of getting an extra 52 bps of return every year through simple day one financial planning.

Estate Tax

It’s worth mentioning here that if the assets continue to grow at a high rate it’s possible that the client might not be able to escape all taxes. And that’s because even though the client can avoid income taxes through step-up in basis here, if the client’s assets are too high, then they may be subject to the estate tax.

Currently the estate tax exemption is about $28 million per couple. That means if the client’s assets are above $28 million they would need to pay 40% in estate taxes on the amount of any assets above this limit at death.

The Effect of the Estate Tax on Generational Wealth

So the better we are here at saving the client income taxes, the more their assets grow and the more they’ll be subject to the estate tax.

That is unless of course, we do some planning now to move assets outside of the estate so the client and their daughter can avoid both income AND estate taxes.

That’s next on the agenda for the client.

And will be a topic we address in a later article here.

But for the purpose of this article it’s worth noting that estate planning today, when the client’s assets are well below the estate exemption limit is again a purchase of an option against a future estate tax exemption and tax-rate.

What if the estate tax exemption drops from $28 million today, to $1 million 30 years from now?

What if the estate tax rate increases from 40% to 55%?

For reference purposes it’s worth noting that back in 1997 the exemption was about $1.2 million per couple and the estate tax rate was 55%.

Your view on future estate tax rates depends on your perspectives on wealth inequality, the deficit, and the government’s future attempts to increase tax revenue.

But what’s undoubtedly clear is that relative to history, today’s exemption limits are exceptionally high and today’s estate tax rate is relatively low.

So setting up a plan to address this issue for the client today at minimal frictional cost is profoundly better than waiting 30 years and trying to solve the problem at the last minute.

Alpha Architect and 351 Tax-Free Exchange

If any of you have large unrealized gains in your portfolio and are interested in doing a tax-free 351 exchange yourself, I believe they are launching their AAUS ETF on July 23rd so you have a little over a month to get your concentrated portfolio in. You can learn more about it on their website here: AAUS - Alpha Architect ETFs . Great idea and benefit to clients and led by a really smart and honorable team.

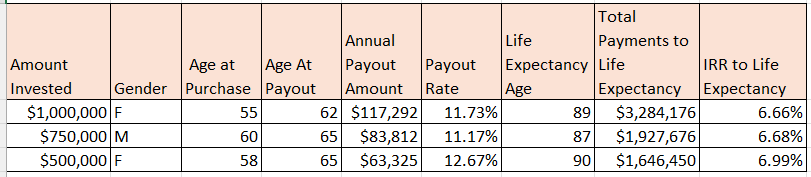

Guaranteed Lifetime Income Webinar: Getting 6%-7% guaranteed returns to your life expectancy

A couple posts ago I covered the benefits of guaranteed lifetime income products and how they’re able to provide clients with guaranteed 6%-7% returns to their life expectancy from the bond side of their portfolio due to arbitrage opportunities that come from the fact that these products have embedded options that most policyowners aren’t using properly.

We’ll be doing a webinar on June 4th at 11 am PST/2 pm EST if you were interested in registering I’ve included the link below:

https://us06web.zoom.us/webinar/register/3017470599891/WN_odkDdNdmR0i7QtcoDbpbAA

Here’s what we’ll show you:

-The importance of reducing investment risk in retirement

-How to get higher yields (6%-7% guaranteed IRRs to life expectancy) from the bond side of your portfolio

-How to defer taxation on the bond side of your portfolio until you’re in a lower tax bracket

-How improving after-tax income from the bond side of your portfolio allows your equity portfolio to compound longer

-The value of financial planning and maximizing arbitrage opportunities

-How to think more strategically about the tax implications of your retirement choices

Sample Guaranteed Lifetime Income Annuity Quotes

About the Author

Rajiv Rebello is the Principal and Chief Actuary of Colva Insurance Services and Guaranteed Annuity Experts. He helps HNW clients implement better after-tax, risk-adjusted wealth and estate solutions through the use of strategic planning and life insurance and annuity vehicles. He can be reached at rajiv.rebello@colvaservices.com.

You can also book a call directly with him here:

Great explanation and examples of a 351 Conversion.