Insurance is not an Investment--well neither is your 401k (Part 2) #5

Both Roth 401ks and permanent life insurance vehicles provide tax-free advantages for high income earners--permanent life insurance just provides for greater contribution amounts and better liquidity

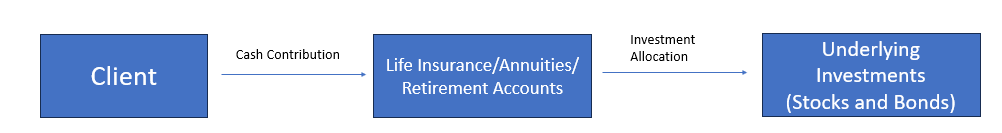

So in our previous post we showed how annuities can be used as investment vehicles similar to traditional 401ks to invest in underlying assets.

In this post we’ll do a comparison between permanent life insurance and Roth 401ks as investment vehicles.

Permanent life insurance is a lot more complicated of a vehicle than annuities. Not only does permanent life insurance require medical underwriting, but it involves a lot more insurance expenses than annuity products do.

So permanent life insurance involves a lot more risk than annuities.

But a key principle of investing is that whenever there is extra risk, there is also the opportunity for extra reward.

Those most apt to manage the risks involved are the ones that receive the benefits for taking that risk—often at the expense of others who don’t know what they’re doing.

While the downside for investing through a permanent life insurance is potentially losing your entire investment, the upside is tax-free returns with the ability for early liquidity.

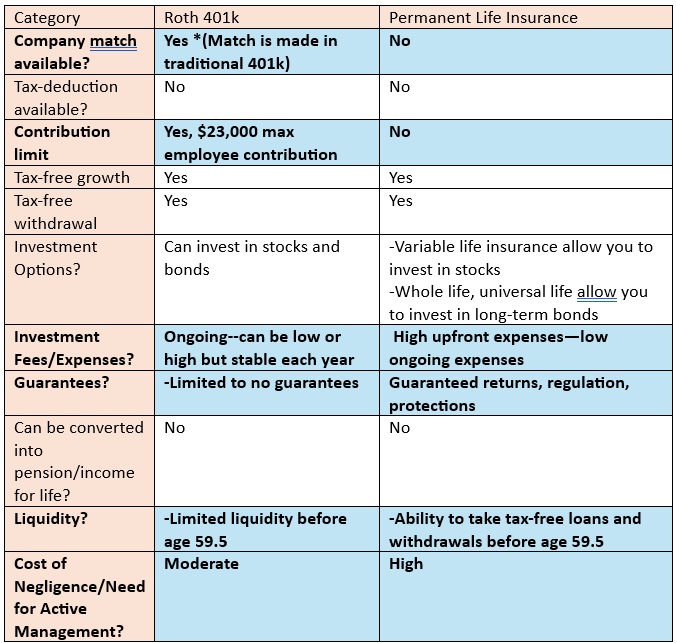

Roth 401k vs Permanent Life Insurance as an Investment Vehicle

Both Roth 401ks and permanent life insurance vehicles offer tax-free growth, tax-free withdrawals and the ability to invest in stocks and bonds.

However as we look at the chart above, there are a couple of key category differences highlighted in blue: company match, the contribution limit, the investment fees/expenses, the guarantees available, the liquidity available, and the cost of not properly monitoring the account/the need for active management.

1) Company Match

Similar to a traditional 401k, Roth 401ks offer a company match as a percentage of the employee contribution. This is something that can’t be found with a permanent life insurance vehicle.

However, a key point to note is that the match here made by the company will typically be made in a traditional 401k vehicle and not the Roth 401k. So your individual contribution will grow tax-free in the Roth 401k, but the company’s match will only grow tax-deferred in a traditional 401k vehicle.

Nevertheless, the ability to gain a match on a percentage of your contribution is a key value add that cannot be afforded by permanent life insurance

2) Contribution limit

Roth 401k plans, like traditional 401ks, have limits in terms of how much an employee can contribute to them. For 2024 this employee contribution amount is $23,000. However only 15% of employees with retirement plans contributed the maximum amount to their retirement plans. It’s worth noting however that 58% of employees earning $150,000 or more per year contributed the maximum amount to their retirement plans.

So while the average American can’t afford to maximize the use of retirement vehicles—the wealthy can and do.

The average American isn’t using the vehicle enough and wealthy Americans on the other hand need more tax-free vehicles because they are already maximizing their contributions to their retirement plans.

This is where permanent life insurance can step in.

Wealthy Americans can contribute significantly more to a permanent life insurance vehicle than they can to their Roth 401k plan or a regular Roth IRA.

This is particularly valuable for Americans who expect their marginal tax-rate in retirement to be close to or higher than their marginal tax-rate when they’re working. This maximizes the value of the vehicle for these individuals.

3) Investment Fees and Expenses

Another key differentiator between a Roth 401k and a permanent life insurance vehicle are the costs of the vehicle.

A Roth 401k will have a stable fixed or percentage fee that stays the same over time.

However, with permanent life insurance the cost of the vehicle is extremely high in the early years and low in the later years.

So part of the comparison that should be made here is really based on how long you intend to use the vehicle in comparison to the costs involved.

For example, if you’re going to invest $1 million into a retirement vehicle, would you rather pay $10,000 a year every year for the rest of your life or $60,000 upfront in year one only?

A simple math analysis here will reveal that if you use the vehicle for longer than 6 years you will end up paying less in fees by choosing a one-time upfront expense as opposed to an ongoing expense every year.

4) Guarantees and protections

While annuities offer the highest valued guarantees of any life insurance product, permanent life insurance products aren’t barren of guarantees. For example, if you invest in whole life insurance you can be guaranteed to earn money on your investment as long as you hold the product for the rest of your life and pay the premiums as indicated.

The downside here though is that this guaranteed return is low especially in contrast to annuities. Obviously permanent life insurance products offer a benefit that annuities don’t offer: tax-free returns.

While this may partially make up for the low guaranteed returns of permanent life insurance, it is by no means a key selling point (whereas the high guarantees of annuities are a key selling point).

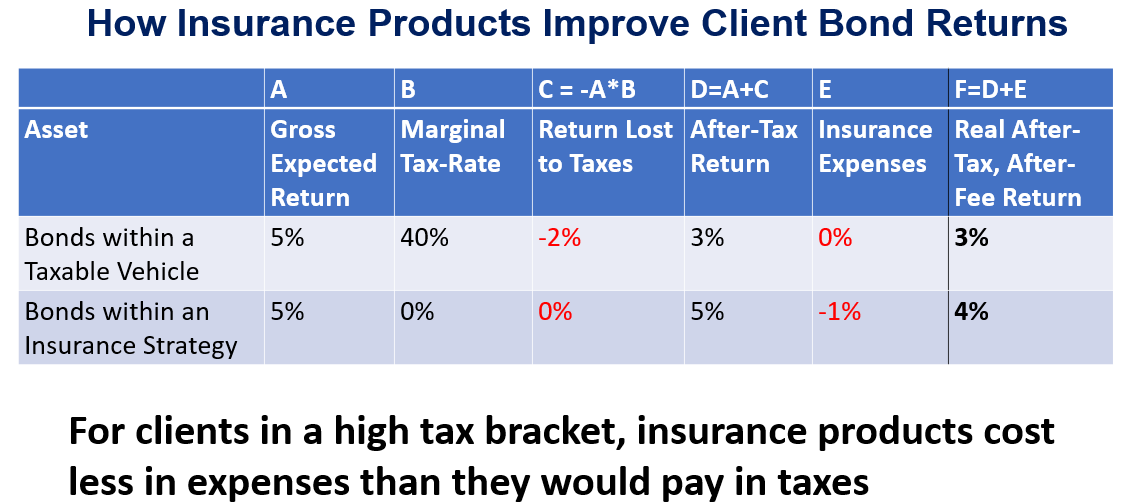

In fact, the value of permanent life insurance comes from properly managing the risk associated with the non-guaranteed returns which have higher risk-adjusted opportunities for clients on an after-tax basis particularly for the bond side of the portfolio.

5) Liquidity

A key advantage that permanent life insurance has over a Roth 401k are the liquidity provisions. A Roth 401k, like most retirement plans, limits your ability to take money out of the plan prior to age 59.5. While clients can typically take as much as $50,000 in loans against their Roth 401k, most plans don’t allow clients to take out any money above this.

This is a key disadvantage of a Roth 401k to its cousin, the Roth IRA. The Roth IRA allows clients to withdraw up to their basis at any time—regardless of how old they are. For example, let’s say a 40 year old client invests $100,000 into a Roth IRA and within 3 years it grows to $130,000. If the client needs access to the money he is able to withdraw up to $100,000 without penalty since that consists of his basis in the Roth IRA—even though the client is only 43 and not over age 59.5. However, the Roth IRA does not permit clients to withdraw above the basis without paying a penalty and taxes.

A permanent life insurance product has significantly better liquidity provisions than either a Roth 401k or a Roth IRA.

It allows clients the ability to remove up to 90% of the account value via either a withdrawal or a tax-free loan.

So in the example above, if the client had $130,000 in a permanent life insurance policy he or she would be able to take out as much as $117,000 from the policy via a combination of tax-free withdrawals and loans.

So for clients in high tax-brackets who are limited in their ability to contribute to tax-free vehicles like Roth 401ks or Roth IRAs, permanent life insurance products afford them the ability to invest large amounts into tax-free vehicles while still having liquidity options available to access the money that they wouldn’t have otherwise.

6) Cost of Negligence/Need for active management

The biggest detractor with permanent life insurance policies, however, is that there is what I call a “high cost of negligence”. What this means is that permanent life insurance policies—with the possible exception of whole life insurance—are not merely set it and forget it type vehicles.

They need to be actively managed over the life of the individual by someone with proper expertise.

The problem with this is the term “Active management” is something that a large part of the educated population has started to have an aversion towards. And rightfully so.

Studies have shown that 90%+ of passive funds that track a benchmark outperform active funds that try and outperform that benchmark.

This has essentially spurred the “index fund and chill” generation of investing with a trend of investing away from the active management of old towards index fund investing.

In fact, in early 2024 the amount of market share in index funds surpassed the amount of market share in active funds for the first time since index funds came on the market in 1976.

This aversion to active management can lead people to believe that there is no value in any form of active management.

Many people avoid financial advisors not because they couldn’t benefit from advice, but because they believe the cost of doing so isn’t worth the advice they’re getting.

As I’ll talk about in later posts, they are not entirely incorrect on this position—but they also don’t fully appreciate the value that customized financial advice can add to investment and retirement planning.

This creates a “do-it-yourself” approach to investing that can work with long-term investing approach.

After all, just purchasing a target date retirement fund or an S&P 500 index fund within a Roth 401k and holding it for the long-term without paying any attention to it isn’t the worst investment decision you can make—especially since millions of people in the country are doing the same thing. If an S&P500 index fund goes to zero, there’s a larger problem with the country than just your retirement investment that you should be worried about.

However, an investment using a permanent life insurance policy as the vehicle, is a lot more dangerous. Without active management, your investment can easily go to zero.

In fact as I talked about in a previous article, 70% of people who purchase a permanent life insurance policy will end up canceling it. Many will get hit with huge surrender charges or have insurance expenses eat up their account value and walk away with very little relative to what they invested in the vehicle.

For these people, choosing to utilize a permanent life insurance policy as an investment and retirement vehicle will probably be one of the worst financial and investment decisions they’ve made.

Active management ensures that you are keeping insurance expenses as low as possible and ensuring that expenses don’t eat up all the benefits you can receive and that you don’t invest in something you have no business investing in.

So while there’s a risk-adjusted opportunity for managing these risks within a permanent life insurance policy, the cost for not managing these risks is significantly higher than just investing via a Roth 401k.

Permanent Life Insurance

Permanent life insurance, like most vehicles for the wealthy, offer tremendous loopholes for creating higher after-tax, risk-adjusted opportunities.

However, they are not void of risk entirely. Rather they replace part or all of the investment risk with behavioral and insurance risks.

These risks are extremely high. However, it’s easier to manage, control, and profit off of human behavior and tax loopholes than it is to find and exploit inefficiencies in the market.

About the Author

Rajiv Rebello is the Principal and Chief Actuary of Colva Insurance Services. He helps HNW clients implement better after-tax, risk-adjusted wealth and estate solutions through the use of life insurance and annuity vehicles. He can be reached at rajiv.rebello@colvaservices.com

You can also book a call directly with him here: